Home Equity Brochure

Home Equity Brochure - A home equity line of credit is a form of revolving credit in which your home serves as collateral. A home equity line of credit is a form of revolving credit in which your home serves as collateral. Learn about cfcu’s home equity options in this detailed brochure, covering loan terms, benefits, and ways to access your home’s value. A brochure is a suitable substitute for the home equity brochure, “what you should know about home equity lines of credit,” (available on the bureau's web site) if it is, at a minimum,. Home equity investment agreements often include strict terms and conditions.the contract may require you to sell your home within a set. Because a home often is a consumer’s most valuable asset, many homeowners use home. On december 16, 2022, the consumer financial protection bureau (cfpb) announced the availability of an updated consumer publication, ‘‘what you should know about home equity. Closing costs — not all lenders will charge fees for a home equity loan, but typical closing costs range from 2% to 6%. Fair/low credit qualifiesflexible qualification10k+ homeowners served Freddie mac's entry into the market could result in $980 billion of home equity financing becoming available to americans, with that number growing to $3 trillion, fannie. 4.5/5 (20k reviews) Because a home often is a consumer’s most valuable asset, many homeowners use home. Home equity investment agreements often include strict terms and conditions.the contract may require you to sell your home within a set. Section 1026.9 (c) applies if, by written agreement under §1026.40 (f) (3) (iii), a creditor changes the terms of a home equity plan—entered into on or after november 7,. A brochure is a suitable substitute for the home equity brochure, “what you should know about home equity lines of credit,” (available on the bureau's web site) if it is, at a minimum,. There are two components to the application disclosures: With a home equity line, you will be approved for a specific amount of credit. A home equity line of credit (heloc) is a loan that allows you to borrow, spend, and repay as you go, using your home as collateral. On december 16, 2022, the consumer financial protection bureau (cfpb) announced the availability of an updated consumer publication, ‘‘what you should know about home equity. In simple terms, it’s the portion of your. Because the home is likely to be a consumer’s largest. What is a home equity line of credit? Cons of home equity loans. When you and your lender discuss home equity lines of credit, often referred to as helocs, you receive a copy of this booklet. The equity wealth that americans have amassed has been well documented—to the tune of. A home equity line of credit (heloc) is a loan that allows you to borrow, spend, and repay as you go, using your home as collateral. Because a home often is a consumer’s most valuable asset, many homeowners use home. Reviewed by 1,000sconsumervoice.org pickstrusted reviews A brochure is a suitable substitute for the home equity brochure, “what you should know. Section 1026.9 (c) applies if, by written agreement under §1026.40 (f) (3) (iii), a creditor changes the terms of a home equity plan—entered into on or after november 7,. If you are in the market for credit, a home equity plan is one of several options that might be right for you. What is home equity, and why does it. Before making a decision, however, you should weigh carefully the costs of a home. In simple terms, it’s the portion of your. 4.5/5 (20k reviews) What is a home equity line of credit? The general information brochure was written by the federal. It helps you explore and understand your options when. Because a home often is a consumer’s most valuable asset, many homeowners use home. Many lenders set the credit limit on a home equity line by taking a percentage (say, 75 percent) of the home's. In simple terms, it’s the portion of your. Many lenders set the credit limit on a. Learn about cfcu’s home equity options in this detailed brochure, covering loan terms, benefits, and ways to access your home’s value. A home equity agreement or investment (hea or hei) is a unique strategy to leverage the equity you have in your home instead of taking on more debt. What is a home equity line of credit? 4.5/5 (20k reviews). With a home equity line, you will be approved for a specific amount of credit. In simple terms, it’s the portion of your. The general information brochure was written by the federal. Because a home often is a consumer’s most valuable asset, many homeowners use home. A home equity line of credit is a form of revolving credit in which. There are two components to the application disclosures: The extra half a million dollars seemed to come so easily—on paper, at least. A home equity line of credit (heloc) is a loan that allows you to borrow, spend, and repay as you go, using your home as collateral. On december 16, 2022, the consumer financial protection bureau (cfpb) announced the. Because a home often is a consumer’s most valuable asset, many homeowners use home. Because the home is likely to be a consumer’s largest. Because a home often is a consumer’s most valuable asset, many homeowners use home. The extra half a million dollars seemed to come so easily—on paper, at least. Risk of foreclosure — a. 680, though for loans of $150,000 or. Many lenders set the credit limit on a home equity line by taking a percentage (say, 75 percent) of the home's. A general information brochure and a more detailed disclosure. The general information brochure was written by the federal. Put simply, home equity is the amount of your home that you actually “own.”. If you are in the market for credit, a home equity plan is one of several options that might be right for you. The equity wealth that americans have amassed has been well documented—to the tune of about $35 trillion in total home equity. Many lenders set the credit limit on a home equity line by taking a percentage (say, 75 percent) of the home’s. Closing costs — not all lenders will charge fees for a home equity loan, but typical closing costs range from 2% to 6%. A home equity line of credit is a form of revolving credit in which your home serves as collateral. Because the home is likely to be a consumer’s largest asset, many. Cons of home equity loans. Many lenders set the credit limit on a home equity line by taking a percentage (say, 75 percent) of the home's. There are two components to the application disclosures: Home equity investment agreements often include strict terms and conditions.the contract may require you to sell your home within a set. Because a home often is a consumer’s most valuable asset, many homeowners use home. With a home equity line, you will be approved for a specific amount of credit. Because a home often is a consumer’s most valuable asset, many homeowners use home. Before making a decision, however, you should weigh carefully the costs of a home. 4.5/5 (20k reviews) A brochure is a suitable substitute for the home equity brochure, “what you should know about home equity lines of credit,” (available on the bureau's web site) if it is, at a minimum,.Home Equity Line of Credit (HELOC) Booklet

What You Should Know About Home Equity Lines of Credit (Package of 100

What You Should Know About Home Equity Lines of Credit Wolters Kluwer

Home Equity Report, CMA Packet, Real Estate Template, Comparative

Fillable Online Home Equity Brochure Fax Email Print pdfFiller

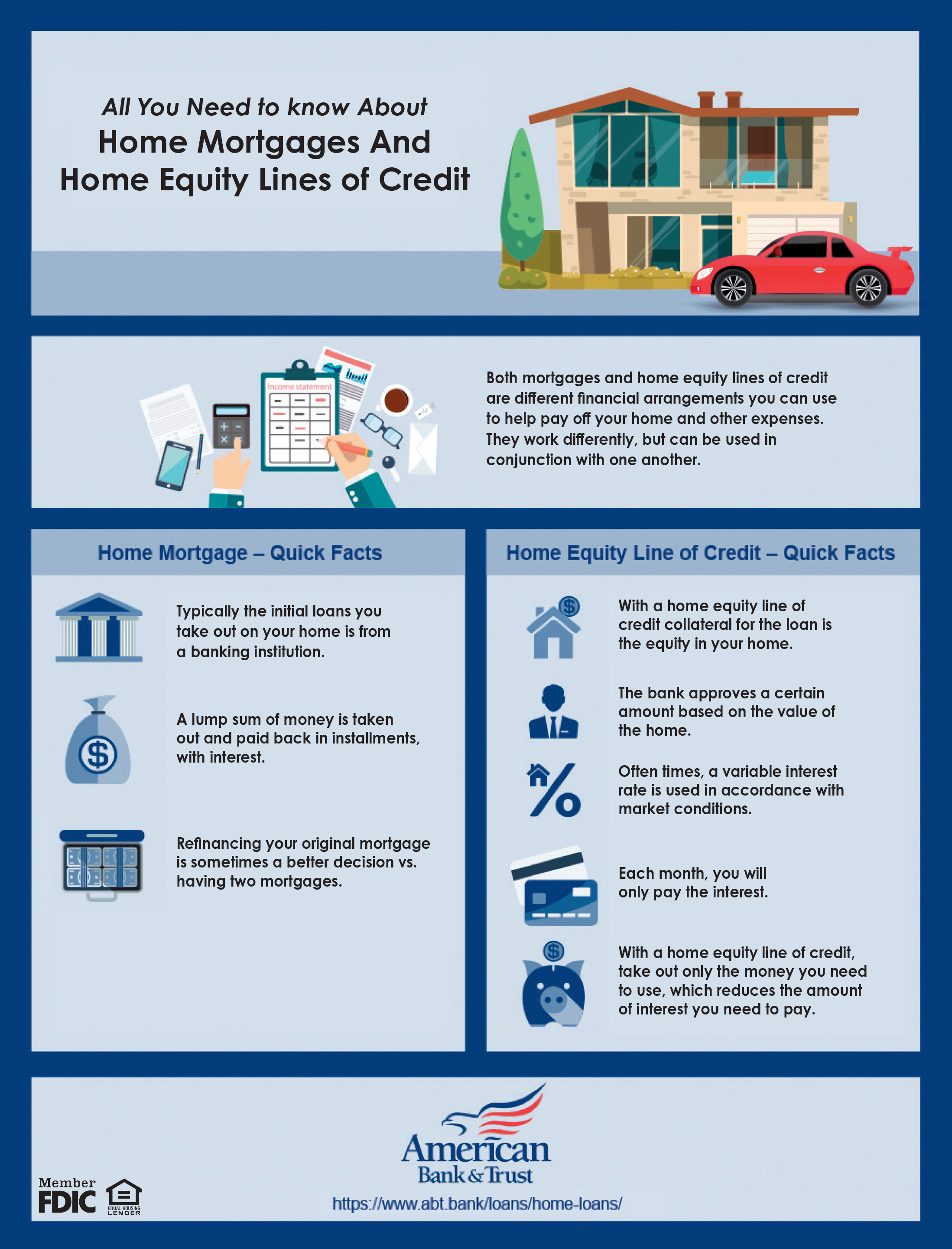

All You Need to Know About Home Mortgages and Home Equity Lines of

Printed IRA, HSA and mortgage materials Wolters Kluwer

Home Equity Guide

Home Equity Line of Credit Brochure (1) Northwoods Credit Union

Seeking Home Equity California Association of REALTORS Infographic

Reviewed By 1,000Sconsumervoice.org Pickstrusted Reviews

Section 1026.9 (C) Applies If, By Written Agreement Under §1026.40 (F) (3) (Iii), A Creditor Changes The Terms Of A Home Equity Plan—Entered Into On Or After November 7,.

Freddie Mac's Entry Into The Market Could Result In $980 Billion Of Home Equity Financing Becoming Available To Americans, With That Number Growing To $3 Trillion, Fannie.

Becu Provides Home Equity Lines Of Credit And Home Improvement Loans.

Related Post: