Cdic Brochure

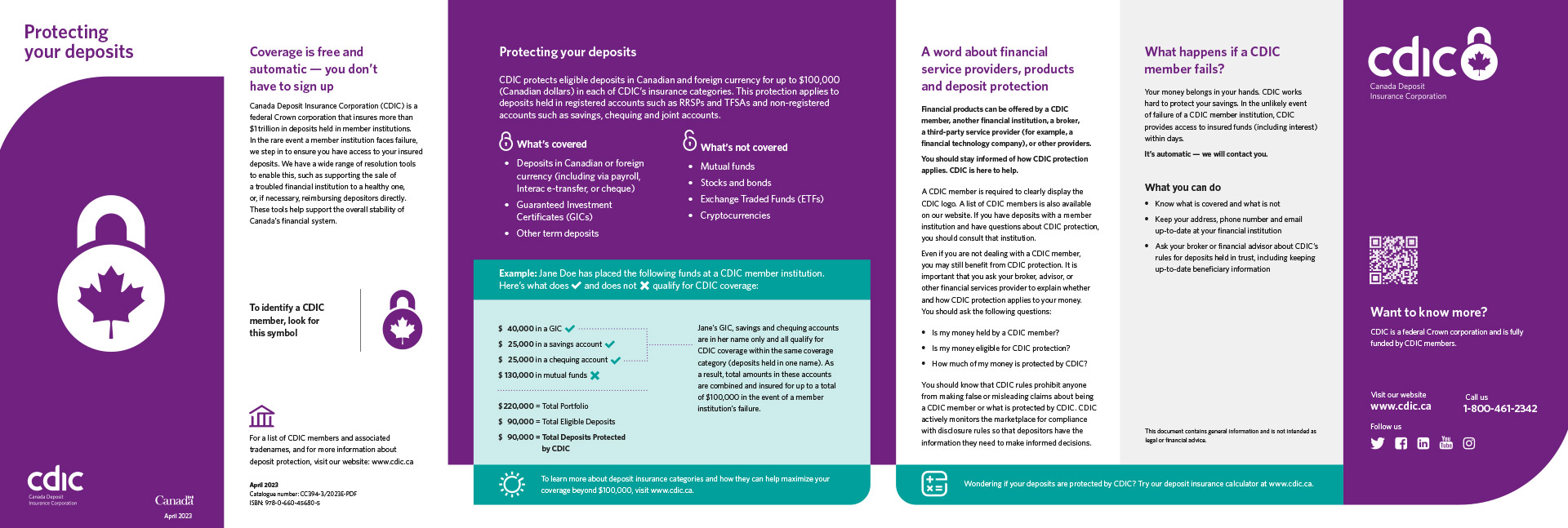

Cdic Brochure - Cdic protects eligible deposits in canadian and foreign currency for up to $100,000 (canadian dollars) in each of cdic's insurance categories. Cdic protects eligible deposits in canadian and foreign currency for up to $100,000 (canadian dollars) in each of cdic's insurance categories. In the rare event a member financial institution faces failure, we. Cdic brochure are displayed in a manner that results in depositors having access to timely information about deposit insurance protection, in an environment where interactions with. Canada deposit insurance corporation (cdic) is a federal crown corporation that protects your deposits for up to $100,000 per insured category at financial institutions that are cdic. Canada deposit insurance corporation (cdic) is a federal crown corporation that protects more than $1 trillion in deposits. To inform depositors about cdic deposit insurance protection, members must prominently display a cdic brochure in branches and on websites. Canada deposit insurance corporation (cdic) is a federal crown corporation that protects your deposits for up to $100,000 per insured category at fnancial institutions that are cdic. Cdic insures canadians' savings in case their bank or other cdic member. The brochure is designed to assist canadians. Cdic protects eligible deposits in canadian and foreign currency for up to $100,000 (canadian dollars) in each of cdic's insurance categories. Cdic brochure are displayed in a manner that results in depositors having access to timely information about deposit insurance protection, in an environment where interactions with. The government of canada has advised cdic that changes to deposit protection originally slated for april 30, 2021 are deferred by one year and will now come into force on april 30, 2022. Cdic protects eligible deposits in canadian and foreign currency for up to $100,000. Cdic protects eligible deposits in canadian and foreign currency for up to $100,000 (canadian dollars) in each of cdic's insurance categories. • requirements to display information about cdic membership and cdic deposit insurance protection (s.5, 6 & 8); The brochure is designed to assist canadians. Cdic protects eligible deposits in canadian and foreign currency for up to $100,000 (canadian dollars) in each of cdic's insurance categories. In the rare event a member financial institution faces failure, we. Canada deposit insurance corporation (cdic) is a federal crown corporation that protects your deposits for up to $100,000 per insured category at financial institutions that are cdic. Cdic protects eligible deposits in canadian and foreign currency for up to $100,000 (canadian dollars) in each of cdic's insurance categories. In the rare event a member financial institution faces failure, we. • requirements to display information about cdic membership and cdic deposit insurance protection (s.5, 6 & 8); Cdic protects eligible deposits in canadian and foreign currency for up. Canada deposit insurance corporation (cdic) is a federal crown corporation that protects more than $1 trillion in deposits. This protection applies to deposits held in. To inform depositors about cdic deposit insurance protection, members must prominently display a cdic brochure in branches and on websites. Cdic protects eligible deposits in canadian and foreign currency for up to $100,000 (canadian dollars). The brochure is designed to assist canadians. Canada deposit insurance corporation (cdic) is a federal crown corporation that protects your deposits for up to $100,000 per insured category at fnancial institutions that are cdic. Cdic protects eligible deposits in canadian and foreign currency for up to $100,000. In the rare event a member financial institution faces failure, we. Cdic protects. The government of canada has advised cdic that changes to deposit protection originally slated for april 30, 2021 are deferred by one year and will now come into force on april 30, 2022. • requirements to display information about cdic membership and cdic deposit insurance protection (s.5, 6 & 8); Canada deposit insurance corporation (cdic) is a federal crown corporation. Cdic protects eligible deposits in canadian and foreign currency for up to $100,000 (canadian dollars) in each of cdic's insurance categories. Cdic protecting your deposits you can go to the canada deposit insurance corporation (cdic) site to access the protecting your deposits page/file. Canada deposit insurance corporation (cdic) is a federal crown corporation that protects more than $1 trillion in. Canada deposit insurance corporation (cdic) is a federal crown corporation that protects your deposits for up to $100,000 per insured category at fnancial institutions that are cdic. Cdic protects eligible deposits in canadian and foreign currency for up to $100,000 (canadian dollars) in each of cdic's insurance categories. Canada deposit insurance corporation (cdic) is a federal crown corporation that protects. Cdic protects eligible deposits in canadian and foreign currency for up to $100,000 (canadian dollars) in each of cdic's insurance categories. Cdic protects eligible deposits in canadian and foreign currency for up to $100,000 (canadian dollars) in each of cdic's insurance categories. To inform depositors about cdic deposit insurance protection, members must prominently display a cdic brochure in branches and. The government of canada has advised cdic that changes to deposit protection originally slated for april 30, 2021 are deferred by one year and will now come into force on april 30, 2022. Cdic protects eligible deposits in canadian and foreign currency for up to $100,000 (canadian dollars) in each of cdic's insurance categories. Cdic protects eligible deposits in canadian. Cdic protects eligible deposits in canadian and foreign currency for up to $100,000. Canada deposit insurance corporation (cdic) is a federal crown corporation that protects more than $1 trillion in deposits. Cdic protects eligible deposits in canadian and foreign currency for up to $100,000 (canadian dollars) in each of cdic's insurance categories. Canada deposit insurance corporation (cdic) is a federal. The government of canada has advised cdic that changes to deposit protection originally slated for april 30, 2021 are deferred by one year and will now come into force on april 30, 2022. Canada deposit insurance corporation (cdic) is a federal crown corporation that protects your deposits for up to $100,000 per insured category at fnancial institutions that are cdic.. Cdic protects eligible deposits in canadian and foreign currency for up to $100,000 (canadian dollars) in each of cdic's insurance categories. The government of canada has advised cdic that changes to deposit protection originally slated for april 30, 2021 are deferred by one year and will now come into force on april 30, 2022. Cdic protects eligible deposits in canadian and foreign currency for up to $100,000. In the rare event a member financial institution faces failure, we. • requirements to display information about cdic membership and cdic deposit insurance protection (s.5, 6 & 8); The brochure is designed to assist canadians. Canada deposit insurance corporation (cdic) is a federal crown corporation that protects your deposits for up to $100,000 per insured category at financial institutions that are cdic. Cdic brochure are displayed in a manner that results in depositors having access to timely information about deposit insurance protection, in an environment where interactions with. In the rare event a member financial institution faces failure, we. Cdic protects eligible deposits in canadian and foreign currency for up to $100,000 (canadian dollars) in each of cdic's insurance categories. Canada deposit insurance corporation (cdic) is a federal crown corporation that protects more than $1 trillion in deposits. Cdic insures canadians' savings in case their bank or other cdic member. To inform depositors about cdic deposit insurance protection, members must prominently display a cdic brochure in branches and on websites. Cdic protects eligible deposits in canadian and foreign currency for up to $100,000 (canadian dollars) in each of cdic's insurance categories. Cdic protecting your deposits you can go to the canada deposit insurance corporation (cdic) site to access the protecting your deposits page/file. Canada deposit insurance corporation (cdic) is a federal crown corporation that protects your deposits for up to $100,000 per insured category at fnancial institutions that are cdic.How we reach out cdic.ca

Final cdic abbreviated brochure en 2 Add up your coverage! We protect

Cdic Abbreviated Brochure en PDF Investing Service Industries

CDIC Publications CENTRAL DEPOSIT INSURANCE CORP.

Brochures, signage and other requirements — CDIC

CDIC Publications CENTRAL DEPOSIT INSURANCE CORP.

CDIC Understanding How Deposit Insurance Works In Canada

CDIC Protecting Your Deposits PDF

Cdic Abbreviated Brochure en PDF

CDIC Understanding How Deposit Insurance Works In Canada

Canada Deposit Insurance Corporation (Cdic) Is A Federal Crown Corporation That Protects Your Deposits For Up To $100,000 Per Insured Category At Financial Institutions That Are Cdic.

• Requirements Regarding The Provision Of The Cdic Brochure To.

Cdic Protects Eligible Deposits In Canadian And Foreign Currency For Up To $100,000 (Canadian Dollars) In Each Of Cdic's Insurance Categories.

Cdic Protects Eligible Deposits In Canadian And Foreign Currency For Up To $100,000 (Canadian Dollars) In Each Of Cdic’s Insurance Categories.

Related Post: