Allianz 222 Annuity Brochure

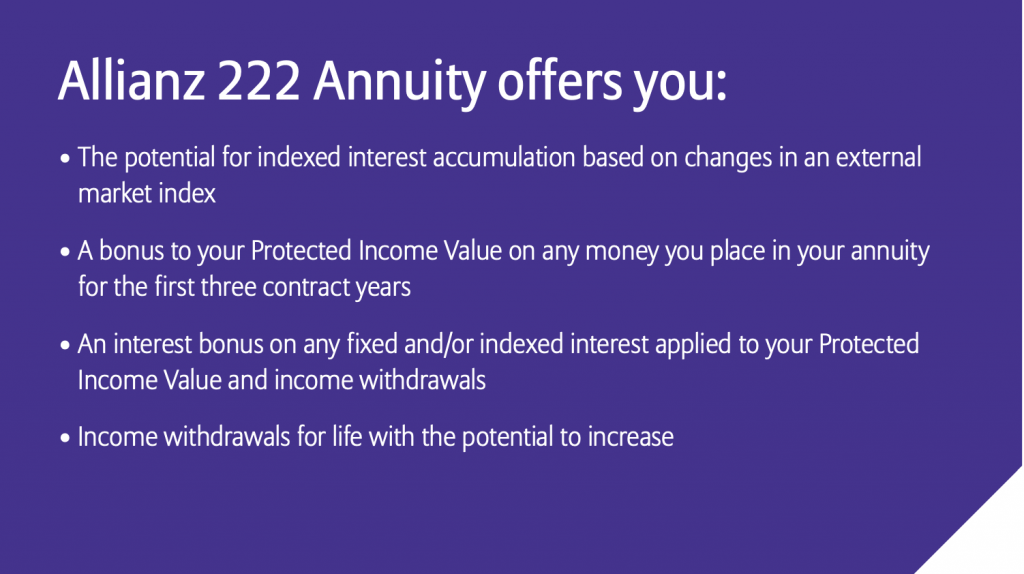

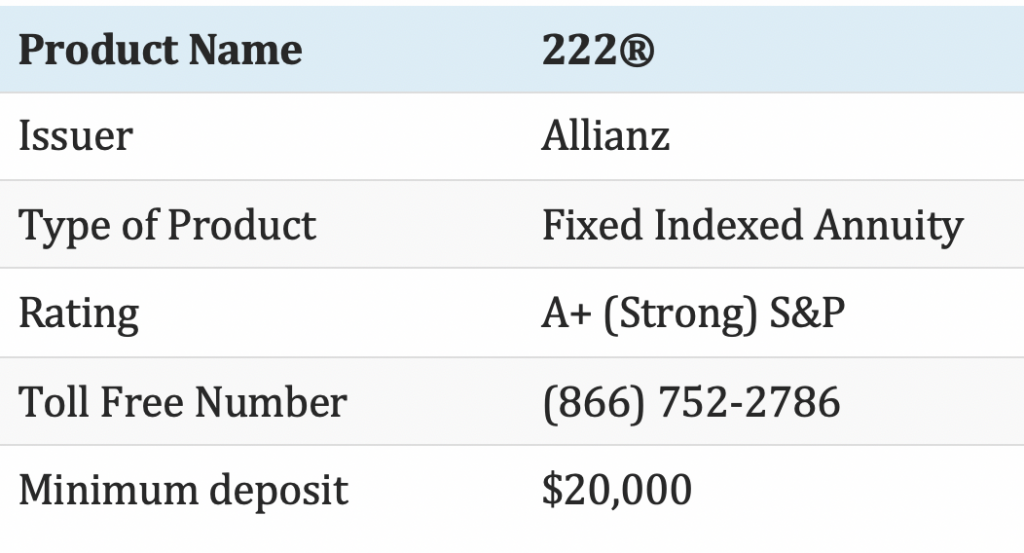

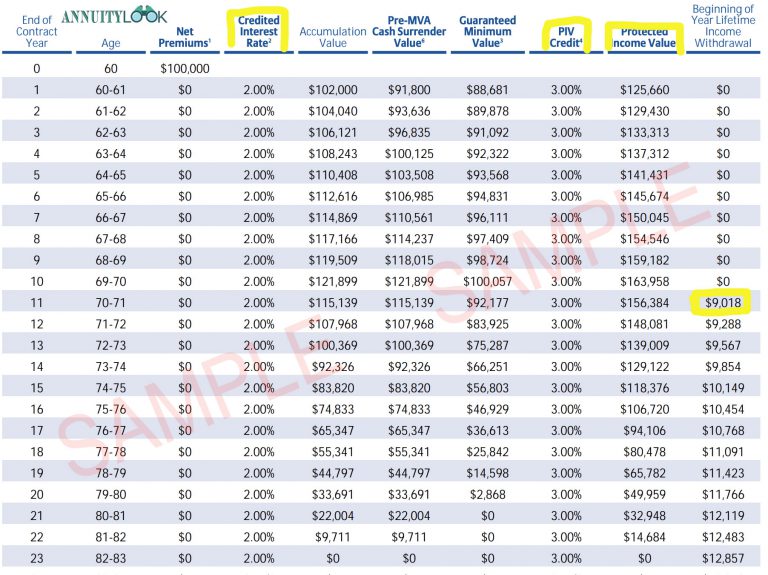

Allianz 222 Annuity Brochure - Strong & stable companypowerful comparison tools1,200+ investment options You can earn interest based on your choice of several index options, Allianz 222 annuity offers additional interest potential through an interest bonus. Here’s a closer look at how the interest bonus could help you accumulate money for retirement. The allianz 222 annuity is a fixed indexed annuity offered by allianz life insurance company of north america. Because it’s a fixed index annuity, allianz 222® annuity gives you the potential to earn indexed interest based on changes in your choice of several indexes and crediting methods. It is designed to provide investors with a combination of principal protection. It also offers lifetime income payments. Allianz 222 annuity gives you the potential to earn interest in two different ways: Earn interest based upon increases in a chosen index allocation; It also offers lifetime income payments. Allianz 222 pays a bonus on your initial deposit as well as a bonus on your future interest earnings, growing your savings in two ways. Allianz 222® annuity get principal protection for a portion of the money you’re saving for retirement income; First, allianz 222 annuity gives you the potential to earn interest in two different ways: Allianz 222 annuity can be a valuable addition to your retirement portfolio for several reasons. See our comparison tablehighest ranked companiesdecisions made easy Allianz 222® is designed to emphasize lifetime income in retirement. Unlike the fancy glossy product brochures or other marketing materials that discuss this annuity and all that it may be able to do for you, the statement of understanding. The crediting periods for this method are two years and five years. This table shows the withdrawal percentages that will. Because it’s a fixed index annuity, allianz 222® annuity gives you the potential to earn indexed interest based on changes in your choice of several indexes and crediting methods. You can earn interest based on your choice of several index options, This table shows the withdrawal percentages that will. Allianz 222 pays a bonus on your initial deposit as well. Allianz 222® annuity illustration guaranteed for the crediting period and will never be less than 5%. Earn interest based upon increases in a chosen index allocation; Allianz 222® annuity get principal protection for a portion of the money you’re saving for retirement income; First, allianz 222 annuity gives you the potential to earn interest in two different ways: See our. First, allianz 222 annuity gives you the potential to earn interest in two different ways: Earn interest based upon increases in a chosen index allocation; Unlike the fancy glossy product brochures or other marketing materials that discuss this annuity and all that it may be able to do for you, the statement of understanding. Allianz 222® annuity illustration guaranteed for. The allianz 222 annuity is a fixed index deferred annuity that offers a premium bonus and an interest bonus credited to the protected income value. Allianz 222 pays a bonus on your initial deposit as well as a bonus on your future interest earnings, growing your savings in two ways. You can earn interest based on your choice of several. You can earn interest based on your choice of several index options, or you can choose. See our comparison tablehighest ranked companiesdecisions made easy Earn interest based upon increases in a chosen index allocation; The allianz 222 annuity is a fixed index deferred annuity that offers a premium bonus and an interest bonus credited to the protected income value. First,. It also offers lifetime income payments. Strong & stable companypowerful comparison tools1,200+ investment options The allianz 222 annuity is a fixed indexed annuity offered by allianz life insurance company of north america. Allianz 222® annuity get principal protection for a portion of the money you’re saving for retirement income; Because it’s a fixed index annuity, allianz 222® annuity gives you. You can earn interest based on your choice of several index options, or you can choose. The crediting periods for this method are two years and five years. Strong & stable companypowerful comparison tools1,200+ investment options View current rates and details for allianz 222® annuity, offering flexibility and potential bonuses for retirement income. Allianz 222® annuity get principal protection for. Allianz 222® annuity illustration guaranteed for the crediting period and will never be less than 5%. Strong & stable companypowerful comparison tools1,200+ investment options Allianz 222® annuity get principal protection for a portion of the money you’re saving for retirement income; Allianz 222 annuity offers additional interest potential through an interest bonus. You can earn interest based on your choice. Allianz 222 pays a bonus on your initial deposit as well as a bonus on your future interest earnings, growing your savings in two ways. First, allianz 222 annuity gives you the potential to earn interest in two different ways: Allianz 222 annuity gives you the potential to earn interest in two different ways: Earn interest based upon increases in. Allianz 222® annuity illustration guaranteed for the crediting period and will never be less than 5%. You can earn interest based on your choice of several index options, Here’s a closer look at how the interest bonus could help you accumulate money for retirement. The crediting periods for this method are two years and five years. The allianz 222 annuity. First, allianz 222 annuity gives you the potential to earn interest in two different ways: Allianz 222 pays a bonus on your initial deposit as well as a bonus on your future interest earnings, growing your savings in two ways. It also offers lifetime income payments. Earn interest based upon increases in a chosen index allocation; Allianz 222 annuity offers additional interest potential through an interest bonus. Allianz 222® is designed to emphasize lifetime income in retirement. Here’s a closer look at how the interest bonus could help you accumulate money for retirement. Unlike the fancy glossy product brochures or other marketing materials that discuss this annuity and all that it may be able to do for you, the statement of understanding. Because it’s a fixed index annuity, allianz 222® annuity gives you the potential to earn indexed interest based on changes in your choice of several indexes and crediting methods. You can earn interest based on your choice of several index options, or you can choose. Allianz 222 annuity gives you the potential to earn interest in two different ways: Professional excellenceadviceretirement products160 years strong The allianz 222 annuity is a fixed index deferred annuity that offers a premium bonus and an interest bonus credited to the protected income value. View current rates and details for allianz 222® annuity, offering flexibility and potential bonuses for retirement income. First, allianz 222® annuity gives you the potential to earn interest in two different ways: You can earn interest based on your choice of several index options,Comprehensive Allianz 222 Review • My Annuity Store, Inc.

Allianz 222 Review Annuity Look

An impartial review of the Allianz 222 Annuity updated August 2021

Allianz Benefit Control Annuity ABC Annuity

The Allianz 222 Annuity Reviewed Atlas Financial Strategies

Allianz 222 Review Annuity Look

Allianz Annuity Forms Form Resume Examples G28BZGr8gE

Allianz Ticket Insurance Review Life Insurance Quotes

【Allianz 222 Annuity】安联 222 指数年金保险 | 投保指南_用户评价_消费者手册 美国人寿保险指南©️

Allianz 222 Review Annuity Look

Allianz 222® Annuity Get Principal Protection For A Portion Of The Money You’re Saving For Retirement Income;

It Is Designed To Provide Investors With A Combination Of Principal Protection.

The Crediting Periods For This Method Are Two Years And Five Years.

Strong & Stable Companypowerful Comparison Tools1,200+ Investment Options

Related Post: